Ira Income Limits 2024 For Deduction Definition

Ira Income Limits 2024 For Deduction Definition. The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. Your personal roth ira contribution limit, or eligibility to.

The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. You can make 2024 ira contributions until the.

$6,500 (For 2023) And $7,000 (For 2024) If You're Under Age 50.

The limit for ira contributions has been raised to $7,000 for 2024, up from the previous $6,500.

The Maximum Amount You Can Contribute To A Roth Ira In 2023 Is $6,500, Or $7,500 If You’re Age 50, Or Older.

Notable 2024 ira updates include:

Ira Income Limits 2024 For Deduction Definition Images References :

Source: liliamickie.pages.dev

Source: liliamickie.pages.dev

Ira Limits 2024 For Deduction Donnie Margaux, This threshold is increased to $8,000 for individuals 50 and older. As of 2024, the ira contribution limit is $7,000.

Source: doralynnwamata.pages.dev

Source: doralynnwamata.pages.dev

Ira Annual Limit 2024 Mitzi Teriann, The latter would kick in. To calculate the taxable amount, subtract eligible exemptions and deductions from total income.

Source: kirstinwlinet.pages.dev

Source: kirstinwlinet.pages.dev

Traditional Ira Tax Deduction Limits 2024 Eryn Odilia, Speculation on income tax exemption limit rising. To calculate the taxable amount, subtract eligible exemptions and deductions from total income.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, You cannot deduct contributions to a roth. The irs limits how much you can contribute to an ira each year.

Source: malindewedwina.pages.dev

Source: malindewedwina.pages.dev

Limits For Roth Ira Contributions 2024 Gnni Shauna, To calculate the taxable amount, subtract eligible exemptions and deductions from total income. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income.

Source: carrishaylah.pages.dev

Source: carrishaylah.pages.dev

Individual Ira Contribution Limits 2024 Elene Oriana, This threshold is increased to $8,000 for individuals 50 and older. The irs limits how much you can contribute to an ira each year.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

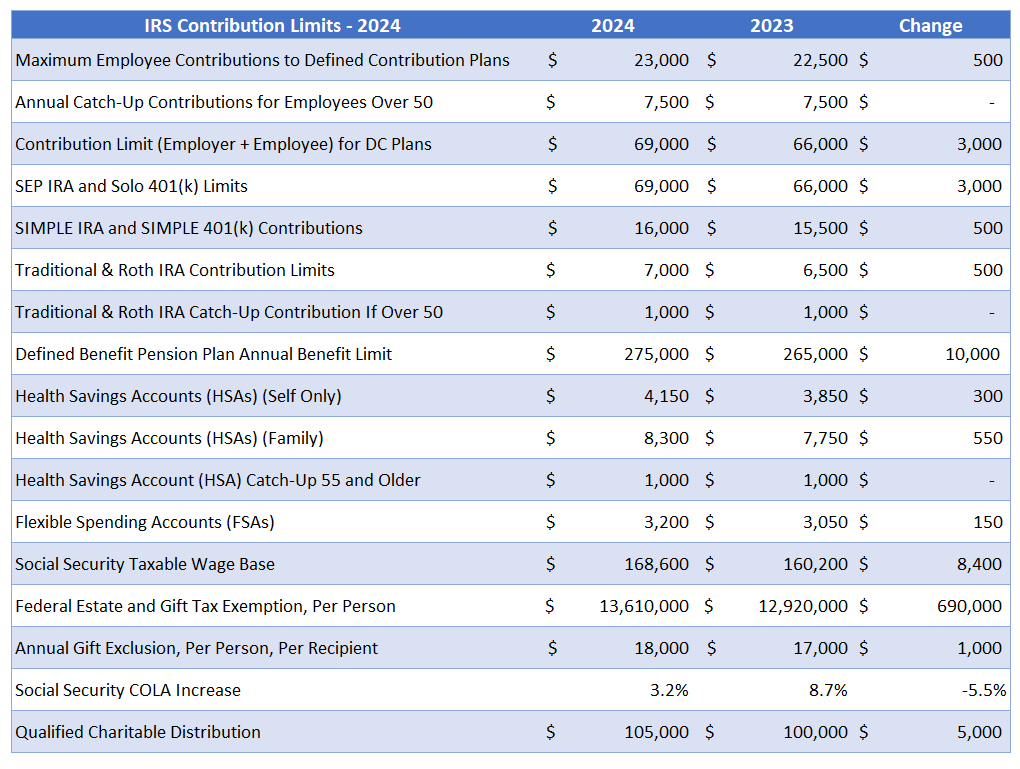

2024 IRA Tax Deduction Retirement Limits Darrow Wealth Management, Ira contribution limits for 2023 and 2024. Calls for increasing standard deduction to rs 60,000 or rs 70,000.

Source: www.financestrategists.com

Source: www.financestrategists.com

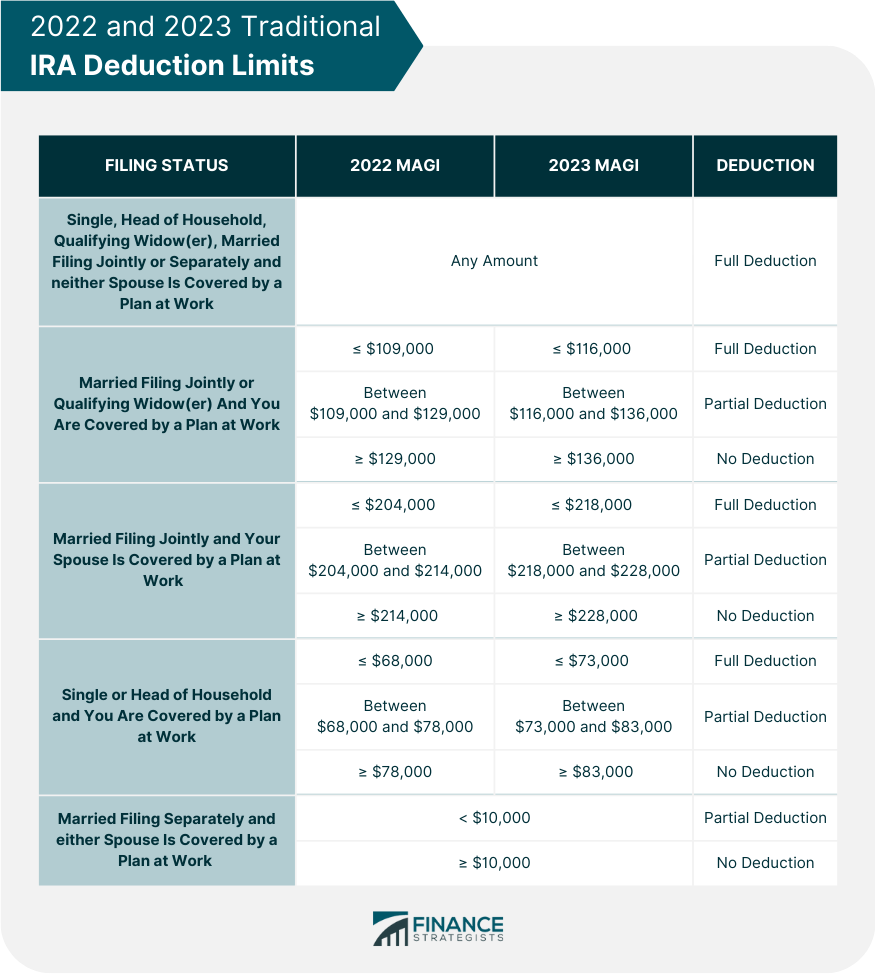

IRA Contribution Limits 2024 Finance Strategists, Your personal roth ira contribution limit, or eligibility to. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income.

Source: suzyqmarybelle.pages.dev

Source: suzyqmarybelle.pages.dev

Ira Contribution Limits 2024 Limits And Mimi Arleyne, Budget 2024 expectations live updates: The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were.

Source: kirstinwlinet.pages.dev

Source: kirstinwlinet.pages.dev

Traditional Ira Tax Deduction Limits 2024 Eryn Odilia, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. These limits are $500 higher than the 2023 limits of $6,500, or $7,500 for taxpayers.

The Ira Contribution Limits For 2024 Are $7,000 For Those Under Age 50, And $8,000 For Those Age 50 Or Older.

For 2023, single filers can no longer.

Your Deduction May Be Limited If You (Or Your Spouse, If You Are Married) Are Covered By A Retirement Plan At Work And.

The maximum total annual contribution for all your iras combined is:

Category: 2024